Prediction markets are rapidly emerging as powerful tools that allow users to speculate on future events by trading contracts based on real-world outcomes. Whether it’s politics, economics, or tech milestones, these platforms are redefining how people access and use forecasting data. As 2025 unfolds, the three major players in this space—Kalshi, Polymarket, and PredictIt—are evolving rapidly, each offering a unique model of how prediction markets should work.

In this in-depth article, we’ll explore how each platform operates, what sets them apart, and why businesses, startups, and Web3 developers should be paying close attention. We’ll also discuss how prediction markets can be integrated into products, forecasting strategies, and even innovation pipelines.

What Are Prediction Markets and Why Are They Gaining Popularity?

A prediction market allows people to trade on the outcome of future events. Each contract represents a yes/no outcome (e.g., “Will inflation exceed 5% by Q4?”) and trades between $0 and $1. If the event occurs, the contract pays $1. If not, it pays $0. The current price reflects the market’s collective probability of the event.

Why are these markets becoming more popular?

- Accuracy: They consistently outperform expert forecasts and polls.

- Transparency: Blockchain-based models like Polymarket show transactions in real-time.

- User-driven: Markets evolve based on user demand and real-world interest.

- Engagement: Prediction trading is interactive and appeals to younger, data-savvy audiences.

Now, let’s look at how the three top platforms differ.

Exploring Kalshi and Regulated Event Market Trading

Kalshi is a CFTC-regulated event exchange operating legally in the U.S. It allows users to trade on everything from GDP growth and inflation to political party control in Congress. The platform uses U.S. dollars and requires identity verification, making it accessible to U.S.-based users who want a secure, legally compliant trading experience.

Launched in 2021, Kalshi has attracted significant attention for being the first federally regulated exchange dedicated to event contracts. It positions itself as a financial tool for traders, institutions, and individuals looking to hedge or speculate on world events in a safe, regulated environment. Kalshi’s contracts span a variety of domains: economic indicators like unemployment rates, CPI data, interest rates; geopolitical tensions; environmental trends; and potentially sports and elections—pending regulatory approval.

One of Kalshi’s key selling points is its credibility. The platform operates similarly to a traditional financial exchange, with a strong focus on compliance and trust. Its markets must be approved by the CFTC, which means new topics are added more slowly, but with greater scrutiny and legal protection.

Kalshi is ideal for users who want to speculate on macroeconomic trends with legal assurance. It’s also becoming a point of interest for financial institutions looking to hedge against real-world events.

How Polymarket Enables Global Crypto Event Forecasting

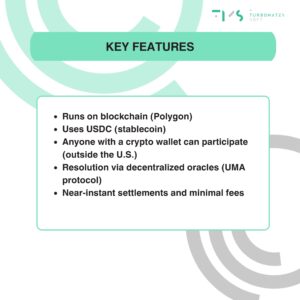

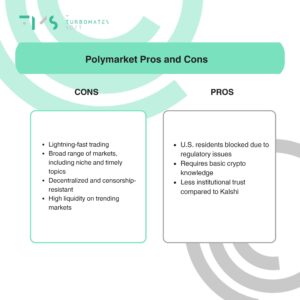

Polymarket is a decentralized prediction platform built on the Polygon blockchain. It allows users worldwide (excluding the U.S.) to trade on an incredibly broad range of topics—from crypto updates and sports to scientific breakthroughs and internet trends.

Launched in 2020, Polymarket gained popularity during global events like the 2020 U.S. election and 2022 crypto crash. Unlike centralized exchanges, Polymarket runs on smart contracts, ensuring complete transparency and immutability of trades. Users connect with crypto wallets like MetaMask and transact using USDC, a stablecoin pegged to the dollar.

The most distinctive advantage of Polymarket is its breadth. Markets can be created on nearly anything, allowing users to bet on outcomes such as “Will Bitcoin hit $100k by Q4?”, “Will SpaceX launch Starship successfully before July?”, or “Will OpenAI release GPT-5 by December?”. This agility allows it to be fast-moving and relevant to global news and memes in real-time.

Resolution of outcomes is handled by UMA’s Optimistic Oracle system, with disputes resolved through decentralized governance. While it currently blocks U.S. users due to regulatory pressure, its popularity in Europe, Asia, and Latin America continues to rise.

For global users familiar with Web3, Polymarket is the most flexible and responsive platform on the market. It also provides valuable insight into public sentiment, especially around tech and crypto topics.

🚀 Inspired by Kalshi or Polymarket? Build your own prediction app!

Exploring platforms like Kalshi and Polymarket? Learn how to turn your idea into a successful betting or prediction app with our step-by-step guide.👉 Read more: How to Make a Betting App

PredictIt Focuses on Political Insight and Research

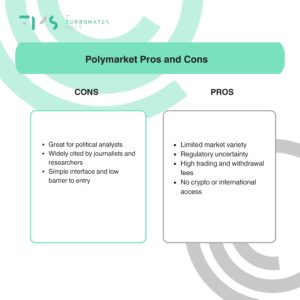

PredictIt is an older platform created in 2014 for academic research and focused mainly on U.S. politics. It was launched under a special “no-action” letter from the CFTC, allowing it to operate as a small-scale market for educational purposes. Unlike its newer counterparts, PredictIt does not use blockchain, and its market scope is tightly focused on political outcomes.

The platform has historically provided accurate election forecasts, and is often cited by media during campaign cycles. It offers binary and multi-outcome markets on events such as presidential elections, congressional seat distribution, and policy decisions. Traders use fiat currency (USD) to buy shares priced between 1 and 99 cents, which pay $1 if correct.

However, PredictIt has faced increasing regulatory scrutiny. In 2022, the CFTC revoked its no-action letter, putting its future in jeopardy. A lawsuit followed, and the platform continues to operate while the case proceeds. Market limits remain: only 5,000 traders per question and $850 max investment per user per market.

Despite its limitations, PredictIt has been a mainstay in political forecasting, offering a valuable historical data set for researchers and political strategists. Its academic orientation gives it credibility, though its longevity may depend on court rulings in the coming year.

| Feature | Kalshi | Polymarket | PredictIt |

| Regulation | Fully regulated (CFTC) | Not regulated | No-action letter revoked |

| Currency | USD | USDC (crypto) | USD |

| Access | U.S. only | Global (non-U.S.) | U.S. only |

| Market Types | Macro, politics, finance | Anything & everything | U.S. politics only |

| Blockchain | No | Yes | No |

| Max Investment | High | Uncapped | $850 per market |

How Businesses Can Benefit from Prediction Markets

Prediction markets are not just for traders—they’re strategic tools for modern businesses:

1. Internal Forecasting

Companies like Google and HP have used internal prediction markets to estimate project timelines, product success rates, and sales performance. By crowd-sourcing internal knowledge, leadership gets more accurate forecasts.

2. Market Validation

Startups can create markets to test demand for a product feature or user interest in a new service. If people are willing to put money behind an idea, that’s strong validation.

3. Risk Management

Event contracts can be used as a hedging tool. For example, a logistics firm could hedge fuel price spikes or supply chain disruptions by trading on relevant market outcomes.

4. Community Engagement

Platforms with built-in prediction markets can drive engagement. Letting users bet on future events related to your business creates buzz, loyalty, and traffic.

Forecasting Meets Web3: A Trend to Watch

Web3 platforms like Polymarket showcase the power of decentralization in forecasting. Developers and founders can:

- Launch DAO-governed forecasting markets

- Add prediction layers to DeFi protocols

- Incentivize knowledge sharing with token rewards

This isn’t just gambling—it’s turning data, belief, and social signals into value.

Regulatory Outlook

Kalshi is fighting to expand regulated prediction markets in the U.S., especially around elections and sports. Meanwhile, decentralized platforms like Polymarket are operating in gray zones, often blocking U.S. traffic but thriving internationally.

The legal future of these markets depends on:

- CFTC rulings

- SEC definitions of event contracts

- New laws adapting to crypto and Web3

Prediction Markets as a Launchpad for Innovation

Whether you’re building a fintech product, a crypto exchange, or a gamified mobile app—prediction markets offer a flexible, engaging framework. You can:

- Build industry-specific prediction tools (e.g., for climate, health, or tech)

- Integrate smart contracts for automatic payouts

- Gamify your app with event-based user actions

With the right development partner, the technical hurdles of blockchain integration, payment systems, and market engines can be overcome.

Let Turbomates Soft Help You Build the Future

At Turbomates Soft, we develop powerful, scalable platforms for Web3, crypto, and forecasting use cases. Whether you’re planning a decentralized prediction engine, an internal enterprise forecasting tool, or a crypto-integrated app—we can help.

Our services include:

- Prediction market development

- Blockchain integration

- Smart contract engineering

- Web3 MVPs

- Custom betting logic and dashboards

Let’s build your idea into a product that leads the next wave of innovation.

Contact us to book a free consultation today.