Profit from cryptocurrency exchange development services to start a great product

Cryptocurrency: isn’t it a thing of the past?As cryptocurrency still arouses some skepticism among people, let’s immediately refer to the statistics and see whether this asset has gone mainstream instead of sinking into oblivion.

Over the past decade, Bitcoin’s price experienced a dramatic surge, rising over 540,000% from 2012 to 2022. Fast forward to 2025, the cryptocurrency market remains robust. As of early 2025, the number of cryptocurrency users worldwide has exceeded 560 million, showcasing consistent growth in adoption. Bitcoin continues to dominate the scene, reaffirming its status as the digital gold standard.

Bitcoin’s market capitalization, which topped $1 trillion in late 2021, still underscores its pivotal role in the digital economy. As of 2025, Bitcoin accounts for roughly 50% of the total cryptocurrency market cap, illustrating its sustained influence amid rising competition from newer tokens and decentralized finance (DeFi) projects.

Predictions for blockchain adoption remain optimistic. By 2025, the global blockchain market is expected to surpass $39 billion, driven by a surge in institutional investments, enhanced regulatory clarity, and the expansion of Web3 technologies. Key developments include increasing use cases in finance, healthcare, and supply chain management, positioning blockchain as a transformative force across various industries.

As cryptocurrency adoption grows and trading volumes climb across exchanges, the demand for secure and efficient trading platforms is higher than ever. The landscape is becoming more sophisticated, with heightened focus on regulatory compliance, advanced security measures, and improved user experiences. For crypto exchanges to succeed in 2025, emphasis on scalability, security, and regulatory alignment is crucial.

In this evolving digital asset ecosystem, understanding these dynamics and leveraging the right technology can be the key to capitalizing on the ongoing cryptocurrency revolution.

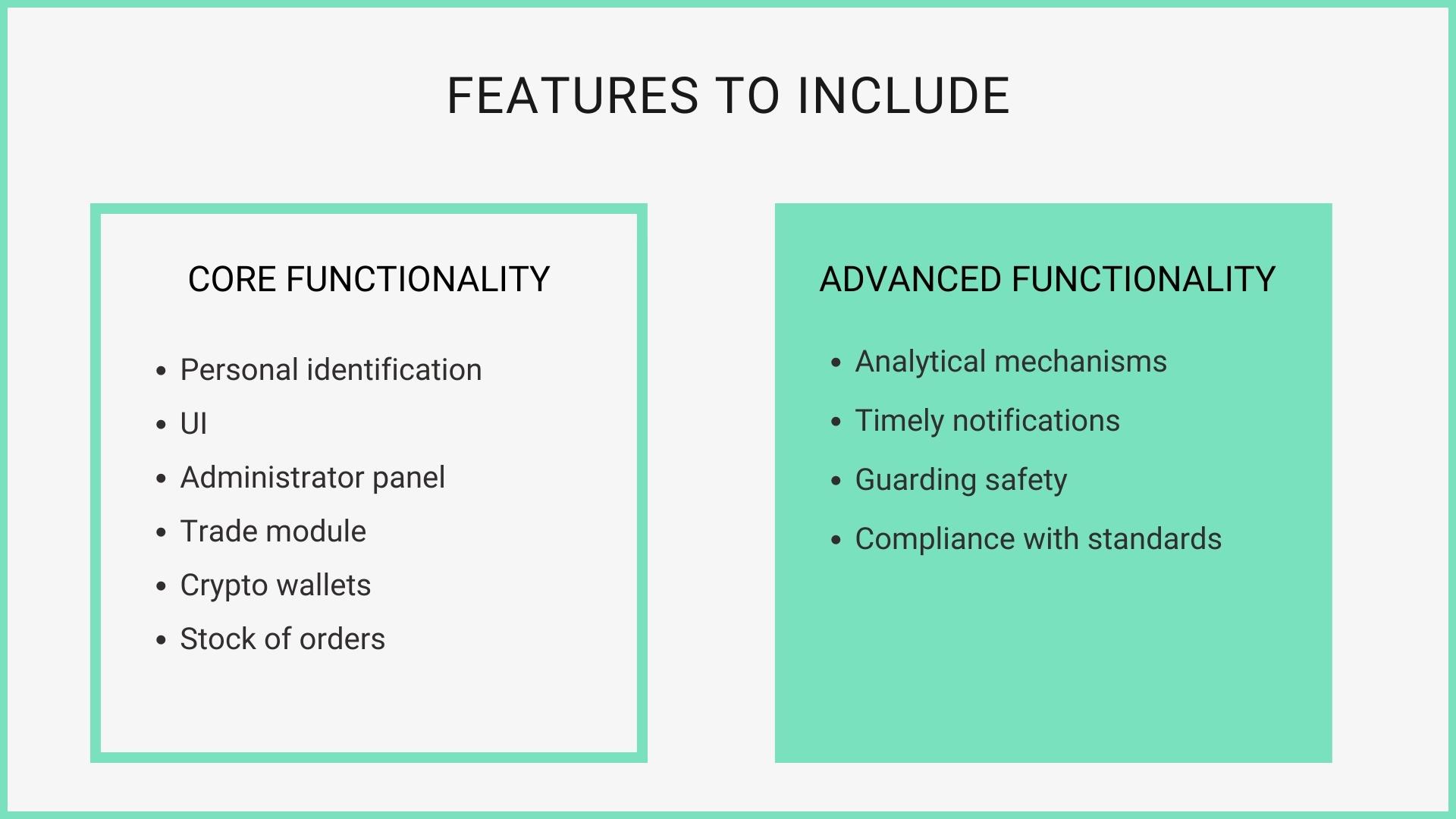

Features to include: what functionality you shouldn’t skip during implementation

Let’s first look at some basics. Here we imply the features any cryptocurrency exchange simply can’t do without.

Core functionalityPersonal identification

Like in real life where all relations or interactions start with an acquaintance, crypto exchanges follow the same logic. Before trading, a user should register on the cryptocurrency exchange platform. Most commonly, emails or SM accounts are used for verification, so the service can guarantee utmost transparency of operations, while eliminating all fraud attempts.

UI

Judging a book by its cover is one of the most common practices, which works with a crypto currency exchange’s user interface as well. Try to avoid overcomplexity and tricky navigation – we recommend you to lean toward an uncluttered and intuitive UI emphasizing the key functionality, like Buy / Sell Orders, View Latest/Selected Transactions, Show Statistics, Check the Balance, etc. If a user interface is about quick and easy customizations, this adds much weight to its reliability.

Administrator panel

First, an admin panel serves as a board to control all operations across crypto exchanges and keep track of ongoing transactions, incoming traffic, trade turnover, and more. Beyond monitoring of transactions, the administrator panel covers content management functions, user verification mechanisms, and suspicious activity tracking and prevention.

Trade module

While the admin panel acts as an operations tracking tool, the trade functionality is in charge of transactions processing, data management, and user paying capacity examination.

Crypto wallets

They are responsible for the safety and accessibility of cryptocurrency. Easy crypto transfers, spendings, replenishments, or withdrawals – all these and other transactions are allowed with the help of a cryptocurrency wallet.

Stock of orders

The component stores all cryptocurrency buying and selling orders which are currently open. The orders are generated automatically in the system and after being closed, they move from the stock of orders to the history of transactions.

To delight demanding traders having years of experience behind, it’s not enough to introduce them to a must-have set of cryptocurrency platform features. They want more than smooth operations processing – crypto exchanges are expected to showcase current market conditions, latest news, or hottest trends as well as shape strategic trade roadmaps. Among the forward-looking features of this kind to grab a trader’s attention could be:

Analytical mechanisms

These include Relative Strength Index (for exploring trend significance and probability of price changes) and a Moving Average algorithm that recognizes trends based on the analysis of average price indicators.

Timely notifications

Traders want to be the first to grasp all newly-announced trading news. All major events, including stock market updates and price shifts, won’t go unnoticed thanks to convenient alerts. Mind that they should be helpful and informative, not too pushy and obtrusive.

Guarding safety

Crypto exchanges are too tempting targets for hackers to ignore, therefore the news about cybercriminals and crypto invasions occur on a regular basis.

To prevent your solution from being cyber attacked and gain the reputation of a reliable cryptocurrency exchange, don’t underestimate the support for various protection levels, like two-factor authentication, data encryption techniques, biometric verification, etc.

Compliance with standards

If your target is the presence on the international market, KYC-, KYT-, and AML-compliance should become obligatory for the implementation into your trading solution.

How to create a cryptocurrency exchange to attract traders

Decide on the crypto exchange type firstBefore launching your cryptocurrency exchange solution, make up your mind which scenario of crypto currency trading you find the most attractive. The options available are centralized cryptocurrency exchanges, decentralized cryptocurrency exchanges, and a hybrid method.

To make your selection process easier, we’ll highlight their major advantages.

Pay attention to CEX if your first-priority requirements to a crypto exchange are lightning-fast performance, a smart interface coupled with handy navigation, and rich functionality, such as a variety of trading tools.

DEX is built on two foundations, blockchain and smart contracts, so in case your strategy banks on safety, privacy, anonymity, and a full user control over funds, this option is just what the doctor ordered.

A hybrid type, as you can guess from the name, brings the best of two worlds, combining blockchain tech to never compromise the safety of transactions and centralized servers for fast and numerous transactions.

Carefully study legislation questionsWe’re talking about the nuances of obtaining a license and the legal attitude to crypto business promoted by different countries (be aware that some of them don’t allow dealing with crypto operations at all).

Below is a short list of factors for you to pay attention to while choosing a country to register your business if you’re oriented towards trouble-free crypto operations and a prosperous business overall:

- Delve into the details of legislation

- Learn about political, economical, and market conditions in the country

- Explore ins and outs of a crypto business registration procedure in the region

- Study financial matters and prepare yourself for upcoming expenses

As soon as basic and advanced platform constituents have been presented above, the main task during this stage is to finally define what will be included in your cryptocurrency exchange ecosystem.

To build a cryptocurrency exchange from scratch, or launch it as a white-label platform, that is the question. It’s up to you to choose whether a cheaper price in tandem with faster TTM or an abundance of customization will win, as the selection of the solution will directly depend on your top-priority strategy goals.

Regardless of the choice you make, we’re ready to cover the accompanying development, customization, and deployment activities.

Move on to a testing phaseAlways bear in mind that you’re dealing with personal data and sensitive information, so the cost of system failure can be fatal. But don’t worry, this horror story won’t become your reality if you don’t underestimate testing manipulations across an entire trading cycle, including registration, sales and purchases, depositing, and withdrawing.

Enter the market with your crypto exchange solutionSystem enhancement is a never-ending process even after the exchange has gone live. The traders who get acquainted with your service are a valuable source of feedback, improvement ideas, and suggestions, which will help you capture a wider audience if you make the most of their advice.

On top of gradually complementing your solution with cutting-edge features that win over more and more users, stay alert for possible dangers of hacking. There’s no margin for error here.

How to make your own cryptocurrency exchange? Come find the answer!

Isn’t it sound tempting to avoid the headache with the crypto exchange creation across all development stages? Turbomates Soft offers full-cycle cryptocurrency exchange development services, which means that a thorough analysis of customer requirements, solution architecture design, smart contract development, UX/UI design, third-party integrations, and tech support are included.

If you’re indulging in doubts or feeling there are some open questions still remained, request a free consultation from our experienced team to release yourself from all concerns.